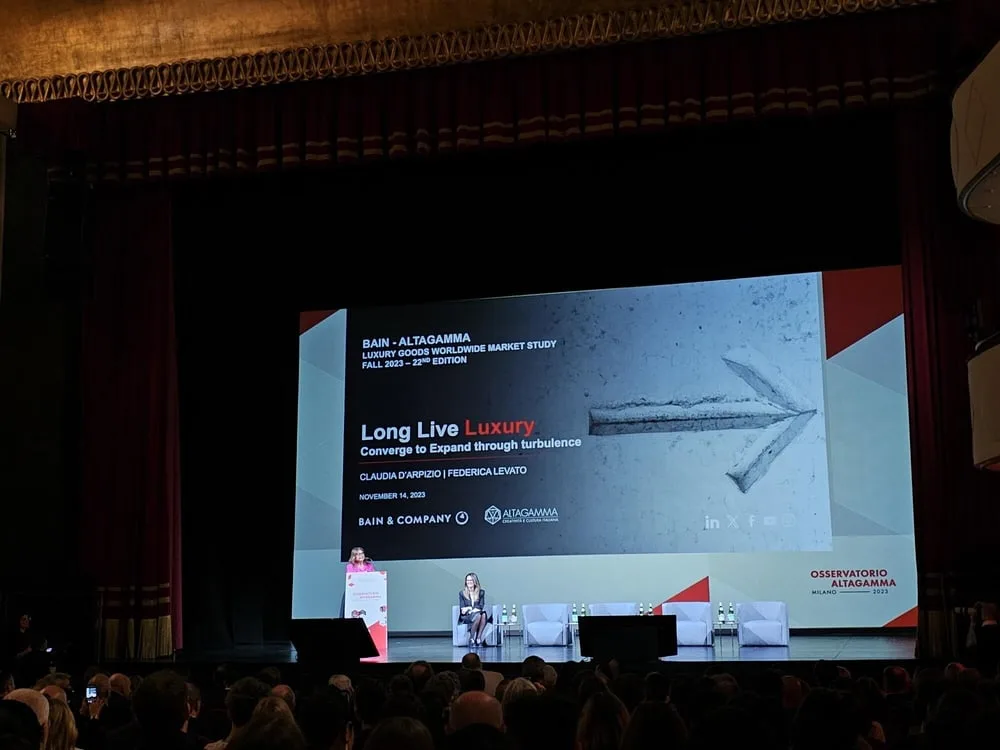

In the dynamic and uncertain luxury goods market, survival and growth now demand a strategic pivot towards alliances, partnerships, and mergers and acquisitions. This imperative is unanimously acknowledged by stakeholders in the luxury industry, especially crucial as the market experiences a notable slowdown in 2023, entering a phase of normalization.

Outlined in the latest report by Bain & Co. in collaboration with Altagamma, the global luxury sector—encompassing fashion, leather goods, jewelry, watchmaking, and beauty products—is projected to generate €362 billion in revenue in 2023, with a modest growth of 4%—a substantial dip from the remarkable 22% growth in 2022. Factors such as the deceleration of the US market, unfulfilled expectations of China’s rebound, and a global slump in local consumption expenditure, exacerbated by geopolitical tensions, contribute to the challenging landscape.

Rising operating costs, particularly for raw materials and manufacturing, pose an additional challenge for luxury groups, intensifying as the industry shifts towards sustainability. Small and medium-sized independent labels find it increasingly challenging to grow without substantial investment. Renzo Rosso, the visionary behind OTB conglomerate, stresses the necessity of alliances to achieve critical mass, generate synergies, and secure ideal retail positions in the fiercely competitive market.

Alessandra Gritti, Managing Director of Tamburi Investment Partners, echoes this sentiment, emphasizing that operating independently in the retail channel has become a hurdle for brands, emphasizing the advantage of belonging to major luxury groups.

However, creating large luxury conglomerates in Italy presents unique challenges due to a strong tradition of family-owned businesses coupled with individualism. The difficulty of selling these businesses, coupled with the absence of inheritance tax concerns in Italy compared to France, hinders the formation of such conglomerates.

Alessandro Binello, Managing Director of Quadrivio Group, emphasizes the need for major infrastructure and funding in Italy to prevent independent labels from being overshadowed by larger counterparts. The importance of clustering is exemplified in luxury goods manufacturing by Gruppo Florence, a collective of high-end producers, showcasing the benefits of collaboration, particularly in the face of challenges like sustainable development and generational handovers.

The luxury industry is witnessing an era of increasing partnerships, mergers, and acquisitions, driven by the demand for diverse experiences. Claudia D’Arpizio, Partner at Bain & Co., anticipates a comprehensive effort by luxury labels to enter various segments, including the hotel and restaurant business. Mergers and acquisitions are becoming fundamental growth drivers, providing brands with enhanced visibility and the ability to gather crucial consumer data.

In navigating this evolving landscape, the luxury industry finds resilience and growth potential through strategic alliances, reflecting a paradigm shift in how brands approach the challenges of the new normal.